The Institute for Renewable Energy has prepared the latest database of photovoltaic projects in Poland. As of Q3 2023, the database contains 6,929 projects with connection conditions issued, with a total capacity of more than 18 GW. Compared to the previous database with information at the end of Q1 2023, there was a 41% increase in the number of projects and a 46% increase in the total capacity (during the six months, the full capacity of valid conditions for connection of photovoltaic installations to the grid almost tripled).

A large number of valid grid connection conditions and refusals for new projects

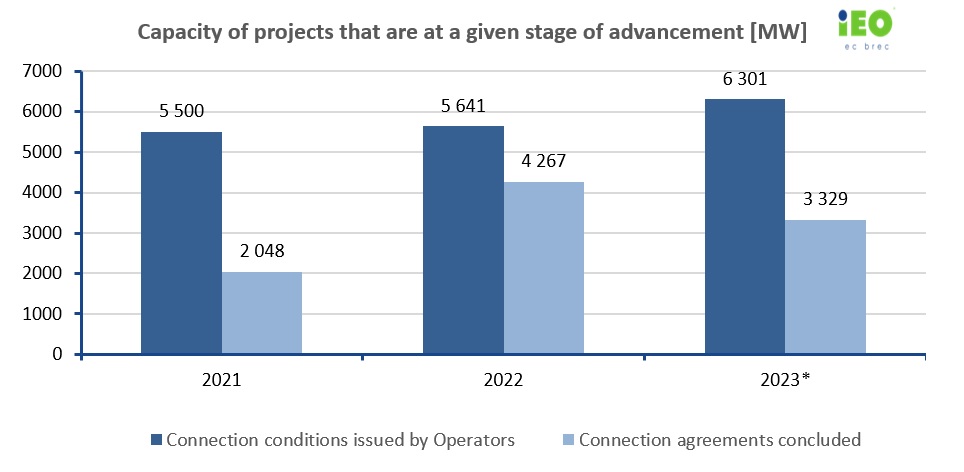

The figure below shows the distribution of photovoltaic projects with still valid grid connection conditions issued charted from November 2021 to October 2023, along with information on the connection agreements concluded.

Figure 1 Power of photovoltaic projects at a given stage of advancement. Source: "Photovoltaic projects in Poland, October 2023," IEO.

Despite the many valid grid connection conditions, the refusals are not falling. From the data collected from the operators, we learn that in Q2 and Q3, Enea did not issue grid connection conditions for 380 projects, of which 320 were over 1 MW. Information on refusals was also provided by Energa, which refused to give connection conditions for 109 projects with a capacity of 312 MW, 45 of which had a capacity greater than 1 MW. The total refusals for Enea was as high as 6283 MW in the last two quarters in Q2 and Q3 of 2023. Among these denials, 5.3 GW were for projects with a capacity of more than 5 MW, and 2.6 GW were for projects with more than 50 MW capacity.

Among the projects collected were those in which energy storage will be located next to the photovoltaic installation. Most photovoltaic projects with energy storage have grid connection conditions issued by PGE.

Are building permits related to the auction system?

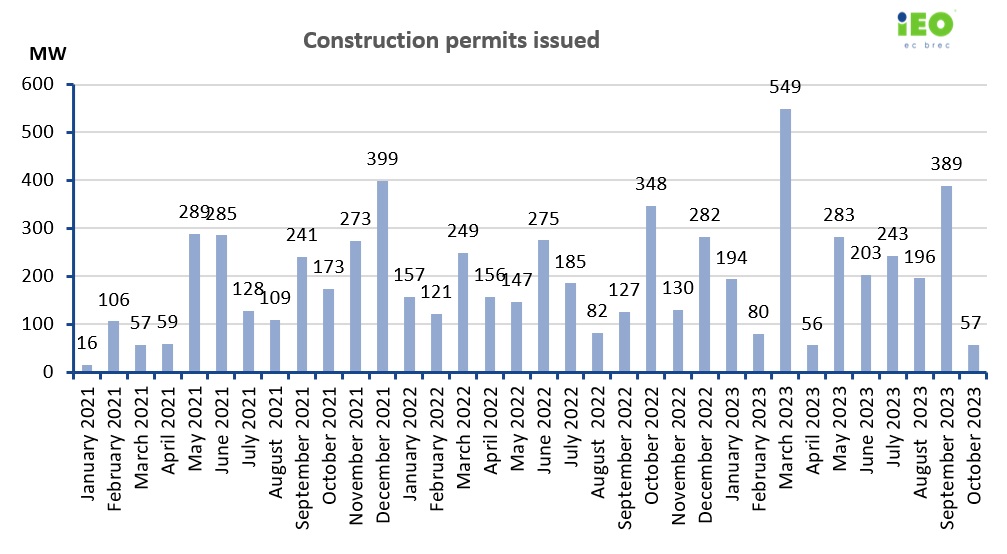

The sizable power of grid connection conditions issued by operators, which are becoming the main focus of developers activities, differs from the power of projects that have received construction permits. Figure 2 gives a monthly breakdown of the number of building permits issued.

Figure 2 Construction permits issued. Source: "Photovoltaic projects in Poland, October 2023," IEO.

The procedure for obtaining a building permit, especially for a large project, is lengthened by, among other things, the need to submit an environmental assessment, but - with the continued supply of projects with grid connection conditions - the lengthening of procedures does not explain the several-fold decrease in the acquisition of permits in October this year, with an increase in their number in March (despite the lack of a summer RES auction).

Since the last RES auctions in December, 6.6 GW of connection conditions have been issued for PV projects, among which 1.2 GW have received construction permits. More than 2.5 GW of building permits were issued for PV projects between December 2022 and November 2023.

November auctions for RES energy, including energy from PV farms, are approaching. According to the RES law, PV projects with issued construction permits (a condition for proceeding to the auction) in a shared basket, together with wind farms, can expect to contract energy from a minimum of 3 GW of new capacity (0.7 GW in PV projects and 2.3 GW in wind projects). But in case PV investors offer only 70% of the capacity in the auction system - which is in line with the experience of the last auction (the other half of the volume would then be PPA contracts, for example), the capacity of PV projects in the auction system could increase to 1.4 GW. Taking into account additionally the fact that in this year's auctions, the share of wind farms will be negligible (no ready projects with construction permits; in 2023, due to the delay and ineffective amendment of the distance law, only eight projects obtained them) the capacity of PV projects submitted to the auction system could reach up to 3.1 GW. No new projects with such power are ready to undergo prequalification and participate in the auctions (too few building permits). Still, there are more than 0.7 GW ( the minimum the legislator assumes).

Compared to previous auctions (since 2016, they were usually held in December), this year, in the pre-auction period, one can see an actual and relative decrease in the number and capacity of building permits issued. In previous years, the pre-auction period saw an uptick due to an increase in building permits issued motivated by the desire to participate in the auctions. RES auctions for PV and wind projects in the small basket (<1 MW) and large basket (>1 MW) will be held in the coming days (November 21-22).

Changing market structure of PV projects

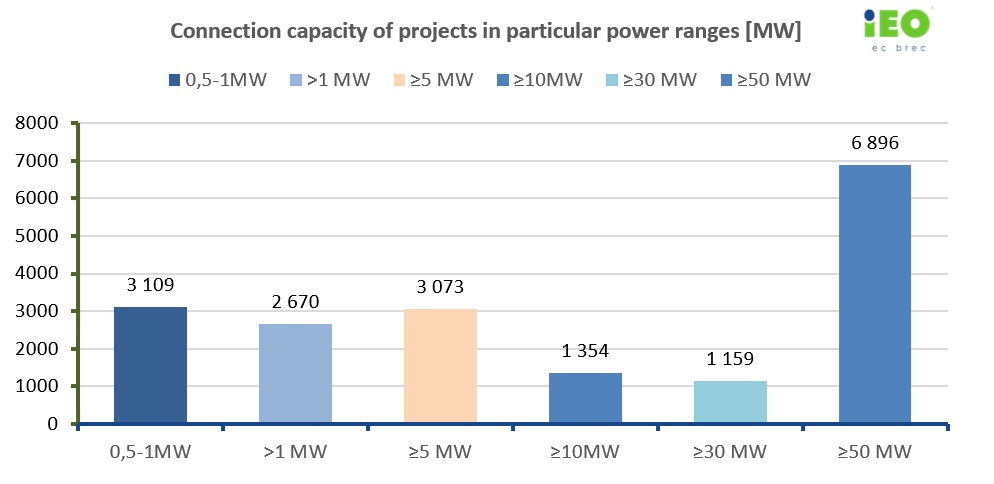

The figure shows the power distribution of PV projects, which illustrates the change in the existing structure. The number of projects with capacities well below 1 MW is increasing, and the number of projects with capacities many times higher than 1 MW is growing. The auction system, with a threshold of 1 MW dividing the small and large auction basket, is no longer the primary determinant of project size. Two factors begin to be decisive: the possibility of obtaining conditions for connection to the grid (low-power project concepts in the business prosumer model with high self-consumption win) and the cost of LCoE energy (large projects win in this competition).

Figure 3 Connection capacity of projects in each power range [MW]. Source: "Photovoltaic projects in Poland, October 2023," IEO.

As seen in the chart above, connection conditions calculated based on power to the grid are mainly issued for large projects. In the project database, the most prominent investors who have obtained grid connection conditions for their projects are Lightsource bp Polska, R.Power and ZE PAK.

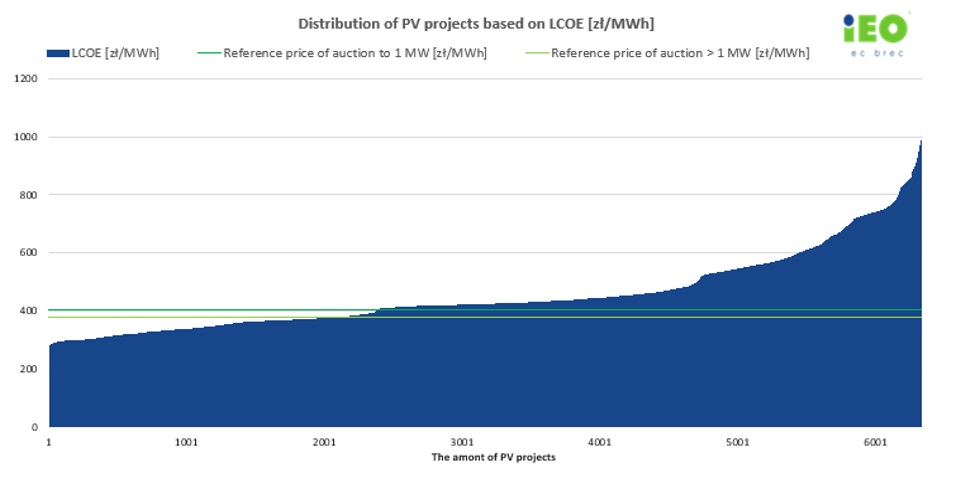

The market below shows the results of the estimated energy production cost calculations of all projects in the IEO database, which confirm that large projects (well-located due to sunshine totals and optimized) give starting lower LCOE energy costs than small, less well-located projects. The chart demonstrates that the best projects provide an energy cost four times lower than the most expensive projects. The chart also shows that established reference prices in this year's auction theoretically allow up to 2,500 new projects in both auction baskets to bid successfully. How many projects will win the auctions, and at what price will be determined by the scale of interest in the auctions and competition, including the ability to take advantage of low prices for PV modules contracted for 2024 and favourable financing?

Figure 4 Estimated costs of LCoE energy production from PV projects with valid grid connection conditions [PLN/MW]. Assumptions: cost of equity 11%, cost of credit 10%, WACC 10.30%, CAPEX and OPEX dependent on capacity, actual solar insolation in a given location. Source: "Photovoltaic projects in Poland, October 2023," IEO.

As of the end of Q1 2023, there were 3404 PV farms in operation, with a total capacity of 3356 MW ("Operating photovoltaic installations in Poland, March 2023"). PV farms account for 26% of installed PV capacity. The IEO's PV market development scenario assumes that at the end of 2025, Polish PV will have 26.8 GW of capacity, and between 2023 and 2025, there will be 14.4 GW in total, including 10.2 GW in small and large PV farms ("PV Market in Poland 2023").

The database "Photovoltaic projects in Poland, October 2023" is available at the link.