The photovoltaic boom in Poland continues

IEO has successfully realised ninth edition of annual report PV Market Report in Poland 2021. Whole report is available in our online shop in English. Check out

The photovoltaic market in Poland is going through a development boom. In the last five years, at the end of 2020, Poland was in the first place in the European Union in terms of the growth rate of photovoltaic power, calculated on the basis of the cumulative annual growth rate - CAGR For Poland, the cumulative (combined) growth rate in 2016-2020 was 114 %, with the EU average of 10.3%. Therefore, in the medium term, we are the European leader in terms of the PV market growth dynamics and in 2020 we approached the world's top 10 countries in terms of power growth (13th place). Successive, better and better international forecasts confirm the strength, potential and growing position of the Polish photovoltaic market.

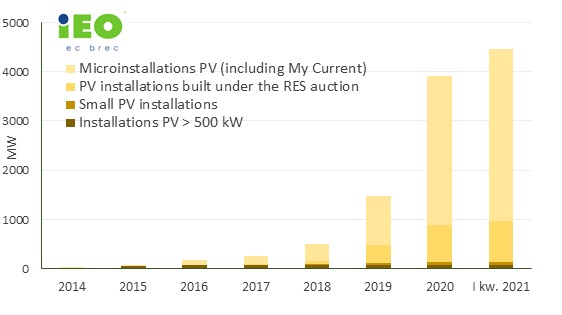

Figure 1 Cumulative installed PV power in Poland, as at the end of Q1 2020, data: ERO, OSD, comp. by IEO.

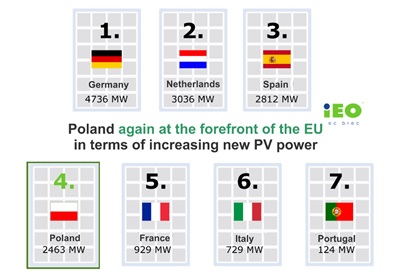

The installed power is gradually increasing, and the growth rate has been extremely high for two years. 2020 was the best year in the history of photovoltaics development in Poland. The installed power in photovoltaics at the end of 2020 amounted to 3,936 MW, which means an increase by 2,463 MW year on year and translates into a 200% increase year on year. Individual prosumers made the greatest contribution to the increase in new power. Thus, according to Solar Power Europe, in 2020 Poland was in 4th place in terms of increasing the installed PV power in the European Union. Only Germany, the Netherlands and Spain overtook us. According to the forecasts of IEO Poland, in 2021, once again in a row, it will maintain a high rate of power increase and the 4th place in the EU. The IEO estimates that at the end of 2021, the installed PV power in Poland may exceed 6 GW. Forecasts also indicate that the total turnover on the photovoltaic market in 2021 will exceed PLN 9 billion.

The installed power is gradually increasing, and the growth rate has been extremely high for two years. 2020 was the best year in the history of photovoltaics development in Poland. The installed power in photovoltaics at the end of 2020 amounted to 3,936 MW, which means an increase by 2,463 MW year on year and translates into a 200% increase year on year. Individual prosumers made the greatest contribution to the increase in new power. Thus, according to Solar Power Europe, in 2020 Poland was in 4th place in terms of increasing the installed PV power in the European Union. Only Germany, the Netherlands and Spain overtook us. According to the forecasts of IEO Poland, in 2021, once again in a row, it will maintain a high rate of power increase and the 4th place in the EU. The IEO estimates that at the end of 2021, the installed PV power in Poland may exceed 6 GW. Forecasts also indicate that the total turnover on the photovoltaic market in 2021 will exceed PLN 9 billion.

Capacity forecast, leading market segments, growth limits

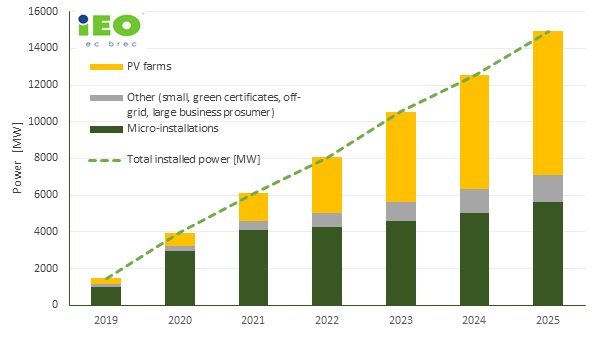

Figure 2 Forecast of the installed power in PV [MW] until 2025, compiled by IEO

According to the IEO forecast, there are no indications for a slowdown in the photovoltaic market in the medium term. PV farm projects prepared for RES auctions, including large-scale ones, will have the main share in the increase in power in the coming years. Even if the pace of development of micro-installations slows down temporarily, the photovoltaics as a whole will not feel this fact in the next few years. It is a flexible, scalable technology, operating in several segments and many market niches. In addition, this year the role of business prosumers will also clearly increase, whose IEO forecasts growth at least 200 MW, and this trend will intensify in the coming years. According to the IEO forecast, the installed power in photovoltaics in 2022 will double its value at the end of 2020 and at the end of 2025 it may reach even 15 GW.

In 2021, photovoltaics may encounter the first regulatory restrictions and related to the limited availability of new projects, both prosumer and farm projects, to the grid infrastructure. Although they do not yet constitute hard barriers limiting further growth, the restriction of access to the Internet may inhibit new investments, even when regulations, the market and the social atmosphere are favourable

RES auctions as the basis for the development of the photovoltaic market

Figure 3 List of auction volumes for wind and photovoltaic projects over the years, compiled by IEO

After 5 years from the announcement of the first auctions, the auction system has become the most important instrument to support the photovoltaic market in Poland. In 2020, the RES auction basket for solar and wind technology with a power of less than 1 MW was once again dominated by solar energy. In 2019, the auction for projects above 1 MW was won by only 3 solar farm projects, but it was a harbinger of increasing competition of photovoltaic technology in this basket. In the renewable energy auction in 2020, photovoltaic installations shared the available volume almost half with wind farms. The distribution of auction prices for the large basket of winning bids shows that large solar and wind projects offered prices at a similar level. This confirms the thesis about the similarity of these markets and the fact that these technologies can already fully compete with each other and one can expect increasing auction volumes for large-scale PV projects.

The market of solar farms up to 1 MW is developing the most dynamically thanks to the auction system. Very strong competition in the "small" auction basket results from the large supply of these projects on the Polish market. According to IEO data, the conditions for connection to the distribution and transmission network are over 5,000. PV projects up to 1 MW with a total connection power of 4.7 GW.

Figure 4 Connection power of projects in individual power ranges, comp. by IEO, based on the database of Photovoltaic Projects in Poland

Currently, in the photovoltaic market, projects of large-scale PV farm (above 1 MW) are already balancing, in terms of connection power, small photovoltaic projects (up to 1 MW). According to IEO database, at the end of March 2021, 610 large solar farm projects with a total power of 5.6 GW had the conditions for connection to the grid. Large PV projects have attracted investors attention for about 3 years. In 2020, 2.8 GW of PV projects obtained the conditions for connection to the grid, and only in the first quarter of 2021 this decision was granted to 1.8 GW of PV projects.

The graph above shows the cumulative power of large-scale PV farm projects in the given power ranges. Among large solar projects, the largest part are projects of large solar power plants - above 50 MW. Most projects in this power area obtained connection conditions in 2020 and in the first quarter of 2021. In 2020, the conditions for connection to the grid were obtained by 10 projects with a total power of 1 GW, while in the first quarter of 2021 the conditions were obtained by 3 projects with a total power of approximately 615 MW.

PV industry and technology supply chain to the market

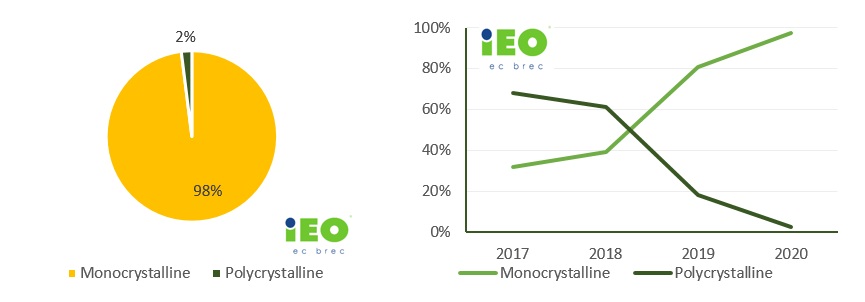

Figure 5 Structure of sales of modules on the domestic market in recent years, compiled by IEO, based on the PV market research conducted by IEO in 2018-2021.

This year's market research showed that monocrystalline modules absolutely dominated the market. It turns out that polycrystalline modules constitute only 2% of the modules introduced to the market by the surveyed sellers. The high share of monocrystalline modules in the market is in line with the trend that was observed in last year's study, when the share of monocrystalline was 80%. However, the almost 100% domination of this type of modules is a surprise. This is due to the fact that in 2017 and 2018 the situation was completely different and it was polycrystalline modules that covered most of the market. The change in the structure of the domestic market of sold modules took place in just 3 years

The PV market is not only the sale of installations to end users, but the entire supply chain generating added value for the economy. According to IEO analyses in photovoltaics, in 2020 the number of full-time employees in the industry could reach even 14.5 thousand while the number of people temporarily working in other forms of employment in photovoltaics may reach 21,000. It is a total of 35.5 thousand jobs in the domestic photovoltaic sector. Employees from the photovoltaic industry constitute a significant group of stakeholders who care about the development of the sector. This opens opportunities for the government and/or the regulator to dialogue with the industry and reach an agreement on the development of directions and support for the development of the entire photovoltaic sector in Poland.

Click on image to look into PV Market Report in Poland 2021