EN

- Details

- Monitoring of the implementation in Poland of the directives on renewable energy sources (RED II), EU regulations on the production of heat and electricity from RES and related directives (Electricity Market Directive, Energy Efficiency Directive).

- Monitoring the amendment to the Renewable Energy Sources Act

- legal updates, planned amendments and implementing regulations

- analyses, interpretations, expert opinions

- the impact of regulations on the profitability and formula of investment execution and the competitiveness of particular technologies

- specific arrangements for prosumers in the service and industrial sectors

- Legislative monitoring of the RES sector

- EU policy on the implementation of the EU climate and energy package, agreeing on and implementing the European Commission's "New European Green Deal", monitoring the implementation of the State's energy policy

- Monitoring of RES grant schemes for 2020-2021 from the point of view of the possibility to take advantage of competitions for RES investments, including ESCO schemes (self-producers and energy communities) and competitions for R&D projects

- Monitoring the development of investment projects and their implementation

- Current statistics on the development of the national RES market and monitoring of investment potential in wind and photovoltaic projects

- IEO's own analyses, forecasts and recommendations for the RES industry:

- RES auctions: including: list of companies that have won the auctions, selected auction projects,

- PPA - Corporate Power Purchase Agreement (contracts for direct sale of energy from RES installations),

- market for certificates of origin,

- electric energy prices,

- changes in the electricity and heat tariff system plus fixed and variable tariffs for companies (business perspective),

- electricity price forecasts,

- green investments in the heating market to adapt to EU directives, e.g. SDH - solar thermal systems for heating companies, gP2H - Green Power to Heat, which means unbalanced electricity from RES, in particular from wind power plants, whose generation profile is similar to that of heating,

- ready-made innovative RES solutions for implementation in energy systems.

- Current, independent political commentary

The bulletin is in the form of Power Point presentations and is prepared every month. Subscription price is determined individually according to a detailed offer tailored to the receiver. We invite you to subscribe to the bulletin and contact us about it at our email address: biuro@ieo.pl

- Details

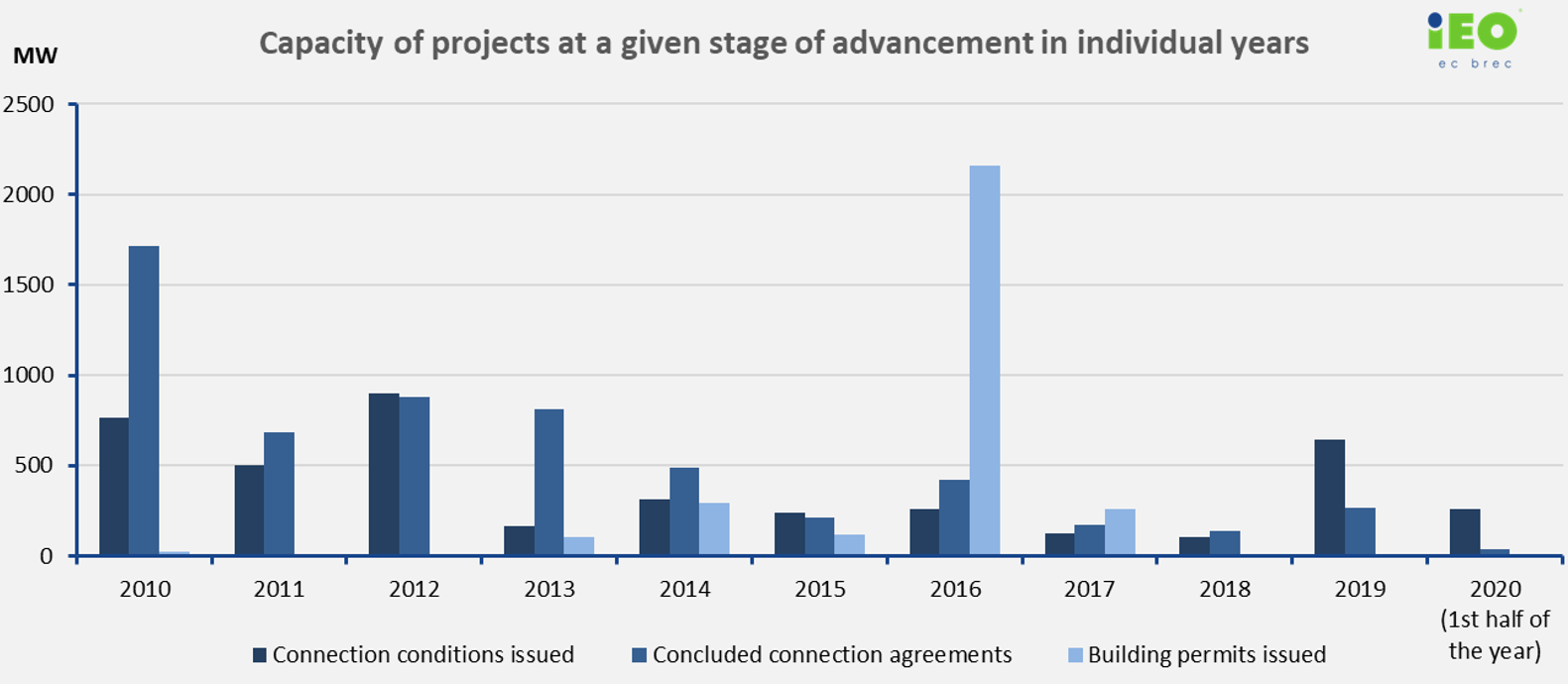

Investors' interest in wind projects in Poland versus 10H Act

The latest IEO data indicate that the entry into force of the so-called 10h Act has essentially blocked the development of new wind energy projects in Poland. Since the Wind Power Investments Act, which requires the location of wind turbines at a distance of not less than 10 times their total height, went into effect in 2016 practically no completely new green field wind project has received a building permit. Projects only change their owner, sometimes insignificant changes are made to them, which only statistically confirm that the development activity is continued.

It can be noted that only those wind farm projects that obtained a building permit before the restrictive regulations came into force had a chance to be implemented (from the stage at which they had been in 2016). Only these investors have a chance to develop these projects using 15 years of support from winning RES auctions.

A common question asked by market participants is how many potential wind projects with a valid building permit can be submitted to this year's auction? Has the wind energy market been completely blocked?

Answers to these and other questions can be found in the latest August update of the Wind Projects in Poland database by the Institute of Renewable Energy (IEO).

According to the IEO, there are still 1.4 GW of wind projects on the Polish market with a valid building permit obtained before the entry into force of the 10H Act. This year's auctions are the last call for these projects to obtain financial support and to complete the investment process within the auctions. A large auction for wind and photovoltaic projects above 1 MW is planned for this year, in which 1.5 GW of wind and photovoltaic farm projects will get a chance to receive government support. So far, in two RES auctions (in 2018 and 2019) for large farms, wind projects with a total capacity of about 3365 MW have won, of which over 2 GW of projects are under construction.

The situation is slightly better when it comes to the successful application for connection conditions. In the Wind Projects in Poland database, wind projects with a total capacity of 7.68 GW have connection conditions issued. Despite the stagnation in applying for new building permits, the projects are at various stages of progress. Some have already participated in auctions in 2018 and 2019, and those with "old" building permits are likely to participate in this year's auction. However, this is not the case for projects whose owners did not manage to obtain a building permit before 2016. On the Polish market, such projects, which have only grid connection conditions issued, are almost 3.2 GW. In the last three years, developers have been active in obtaining connection conditions. New connection conditions received both - projects with old building permits, as well as new projects. In 2020, 23 projects with a total capacity of 261 MW received connection conditions.

Despite the stagnation in applying for new building permits, the projects are at various stages of progress. Some have already participated in auctions in 2018 and 2019, and those with "old" building permits are likely to participate in this year's auction. However, this is not the case for projects whose owners did not manage to obtain a building permit before 2016. On the Polish market, such projects, which have only grid connection conditions issued, are almost 3.2 GW. In the last three years, developers have been active in obtaining connection conditions. New connection conditions received both - projects with old building permits, as well as new projects. In 2020, 23 projects with a total capacity of 261 MW received connection conditions.

The largest capacity of wind projects is still present in the Pomorskie, Zachodniopomorskie and Wielkopolskie Voivodeships. In these voivodeships there are 57% of wind projects, while in eastern Poland the development activity has practically ceased.

A waste of the industry's potential and capital committed is the lack of developers' efforts to obtain a building permit for some projects with already issued grid connection conditions despite the 10h Act. In this group of projects with the capacity (according to the IEO database) of 1.8 GW you can certainly find those that will meet the 10H rule using the latest technologies. Smaller projects (several MW) consisting of new, efficient turbines, economically still win with photovoltaic projects in auctions. They can be implemented in the PPA formula, or in a self-producer's business model, where they could work better than photovoltaics. The under-use of this potential and the capital already committed is difficult to understand from an economic point of view, even if the industry is waiting for the 10H rule to be unblocked. The most regrettable thing is the time that is escaping, which is objectively the best for developed wind energy technology. - Grzegorz Wiśniewski, CEO of Institute for Renewable Energy.

We invite you to learn more about the IEO database "Wind projects and RES auction winners Database - August 2020".

After clicking on the cover you will be redirected to the IEO store.

- Details

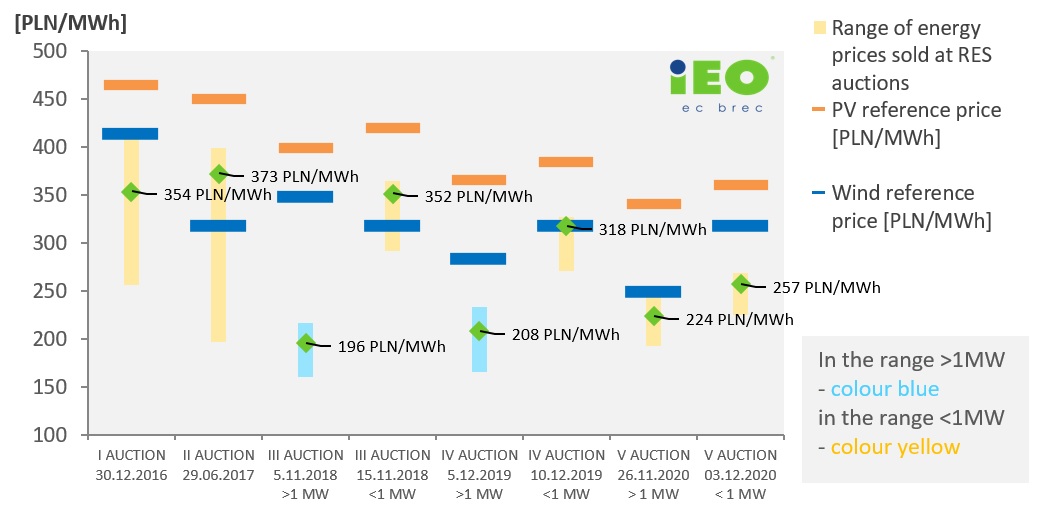

Based on the database of photovoltaic and wind companies "RES Auctions Winners 2016-2020"

In Poland the market of solar farms up to 1 MW is developing rapidly thanks to the polish auction system. Not surprisingly, competition in the "small basket" for wind and photovoltaic projects up to 1 MW was fierce. According to the announcement of Energy Regulatory Office, 590 producers joined the auction with a total of 1618 bids, and all the bids submitted were from photovoltaic only. The auction was resolved in favor of 235 producers, which submitted a total of 747 bids with the lowest price. The minimum energy price was 222.87 PLN/MWh - for comparison, in 2019 the minimum price was 269 PLN/MWh. On the other hand, the maximum price at which energy was auctioned in 2020 was 268.88 PLN/MWh - in 2019 it was 327 PLN/MWh. This shows that the high competition and the decrease in the prices of photovoltaic modules significantly affect the decrease in the auction prices.

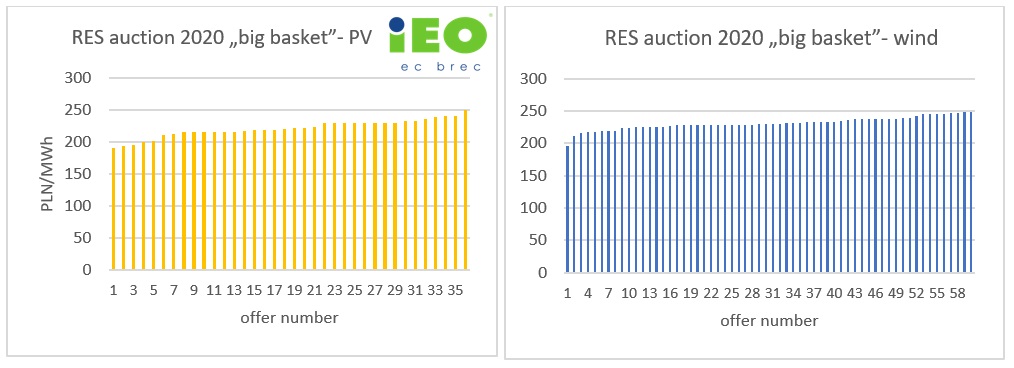

Renewable energy auctions are the last call for wind farm projects blocked by polish “10H Act”. So far, the wind energy-dominated "large basket" (for projects above 1 MW) auction in 2020 succumbed to cheap photovoltaic technology. The 2019 auction, in which 3 PV farm projects won in this basket, was only the beginning of the PV "revolution" in this basket. In the 2020 auction, PV projects equalled the number of bids and capacity of wind power plants. In order to win the auction, PV investors went well below the reference price - the reference price for PV was 340 PLN/MWh, while the maximum price at which energy was sold in this auction was almost 100 PLN/MWh lower (249.90 PLN/MWh). The distribution of auction prices for the large basket of winning projects according to Energy Regulatory Office data (prepared by IEO) statistically confirms the thesis that wind and solar projects markets are similar - figure below.

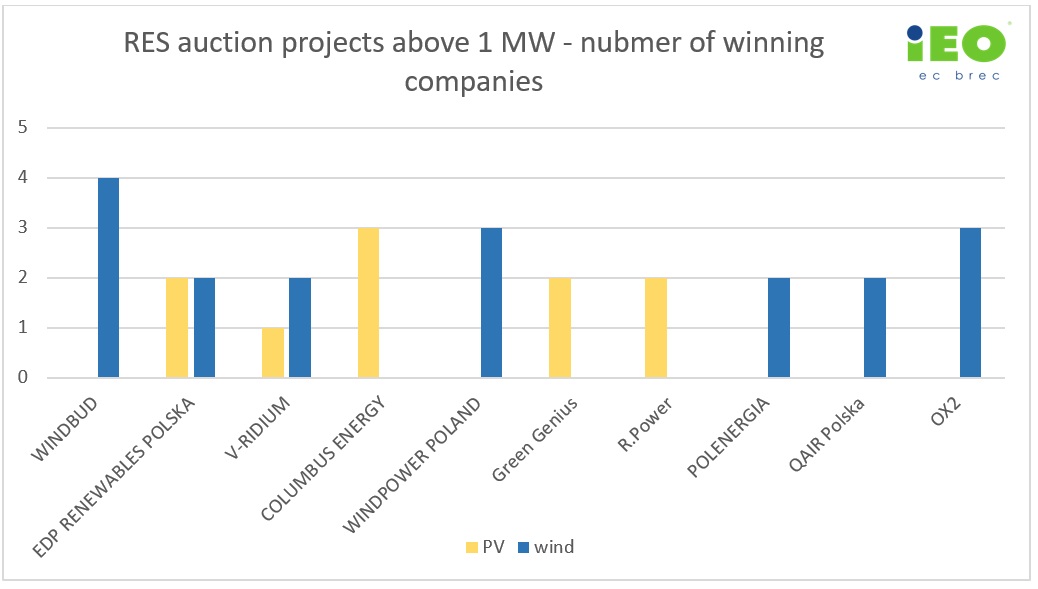

Special purpose companies (SPC) held by holding companies as Windbud, Windpower Poland, Polenergia, QAIR Polska or OX2 won in the auction with wind farm projects, whereas SPC held by Green Genius, Columbus Energy or R.Power won with photovoltaic projects.

Among holding companies with the highest number of winners there are also EDP Renewables Polska and V-Ridium (formerly Geo Renewables), which are operating on both markets and have submitted both wind and photovoltaic projects to the auction.

If you are interested in purchasing the database of the winners of previous auctions for photovoltaic and wind energy, we invite you to visit our store: