EN

Institute for Renewable Energy (IEO) was founded in 2001 as an independent research group/think-tank. It is the first private scientific institute in Poland with in-depth knowledge of the entire field of renewable energy, ranging from energy policy and law, electricity prices and tariff forecasts, PPAs, economic and financial analyses of the electric power industry (solar and wind power) and the heating industry (RES, heat storage, sector integration), to technical and design aspects. It is continuously monitoring the RES market and actions of the state administration as well as EU institutions under the watchdog formula.

IEO has very extensive experience as a technical and business advisor (due-diligence, assumptions for technical solutions, functional and utility programs, feasibility studies, business plans, introduction of innovations in the company) in investment processes in the renewable energy sector, carried out by companies and local governments, as well as in research and demonstration projects conducted within the framework of EU research programs.

IEO offers postgraduate studies "Renewable energy for business” and trainings in the area of RES technology, market, economics and law for domestic energy companies and foreign institutions (chambers of commerce, banks and energy companies).

IEO has developed dozens of expert reports and analyses concerning the energy market, business models for the renewable energy sector and the RES equipment manufacturing industry, economic analyses and forecasts for government institutions, public institutions, the European Commission, business clients, as well as dozens of international and domestic research projects. Since 2020, through the company GigaPV, it has been running a construction project of a giga-manufacturing plant for a new generation of solar cells.

For the past eleven years, IEO has published an annual report, "Photovoltaic market in Poland".

Institute for Renewable Energy acting since 2001 on the polish and european renewable energy market, specializes in preparing economic analyzes, market reports, market monitoring and legislative actions in the field of PV- photovoltaic energy, solar collectors, heat pumps, wind energy, biomass energy, biogas plants in the following areas;

- Studies and detailed analyzes of the market state of RES development in Poland and in Europe.

- Technical and economic due diligence of RES projects: solar, biogas and wind in the auction system

- Projects before auctions system have complete construction documentations, with valid building permits and grid connection conditions.

- Winners projects of the RES auctions system are ready to build with a guaranteed price of energy for 15 years.

- Realization on behalf of investors pre-investment and investment processes in various stages;

- Preparation of feasibility studies for the installation of renewable energy sources - for companies and local governments;

- Verification of feasibility studies and functional programs;

- Hosting, developing, updating and analyzing database RES investment, including investments in photovoltaic systems.

- Hosting, developing and updating a database of manufacturers and distributors of photovoltaic equipment and conducting comparative analyzes (technological benchmark);

- Advice and assistance in the preparation of investment:

- Preparation of feasibility studies of the investment projects;

- Consulting in negotiations with financing institutions;

- Reports - assessment of the impact of photovoltaic systems on the environment;

- The development of computer programs and spreadsheets, profit calculation and energy analysis of the economic viability of investments, tailored to the individual needs of customers - installers and manufacturers of renewable energy systems;

- Preparing investors for the applying for financial aid, the use of support systems (eg. green certificates) and effective participation in the auction for the supply of electricity from renewable energy sources in the years 2016-2030;

- Forecasts productivity and optimization of wind power and photovoltaic in the context of ensuring the minimum requirement of guaranteed efficiency of the plant during the 3 years and 15 years periods of time in the law on renewable energy sources;

- Organizing and conducting webinars on key determinants of RES;

- Organization and carrying out postgraduate studies "Investing in renewable energy: distributed generation and prosumers";

- Organization of national conferences;

- Formulating a development strategy for the RES sector and coordination of the campaign for implementation of the sector demands;

- Implementation of expertise for the government and public institutions (the full list of expert opinions is available here).

Achievement of Polish photovoltaics – key data

The IEO report „Photovoltaics market in Poland 2023” shows that the year 2022 was very good for the photovoltaic sector in Poland, better even than the record year of 2021. In 2022, photovoltaics was yet again the leader and the main driving power for the increase in RES market in Poland. According to data of the Energy Regulatory Office, the accumulated power installed in PV at the end of 2022 amounted to more than 12.4 GW, which in comparison to 2021 (7.7 GW) meant a record increase of more than 4.7 GW in new power and constitutes a record 61% increase in market growth.

At the end of the first quarter of this year, the total power of PV installations exceeded 13 GW, with the share of prosumers being 74%, the share of small installations (50–1000 kW) 21%, and large PV farms 5%. The importance of energy from PV installations in energy production in Poland increased significantly. The share of PV energy in electric power from RES increased from 3% in 2019 to more than 23.3% in 2022 and 4.5% in the total generation structure (four years ago, it was only 0.4%).

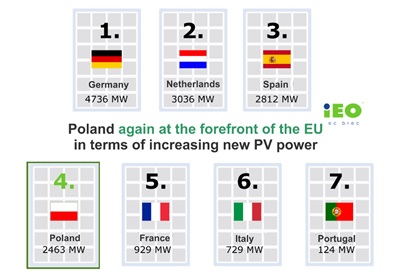

At the end of 2021, the power installed in European Union countries in photovoltaics amounted to 198 GW, which means an annual increase by 36 GW. EU countries achieved a 22% increase in PV installed power in comparison to 2021 – almost three times lower than in Poland. In 2022, Poland was ranked again on the second place, after Germany, in terms of increase in the PV installed power in the European Union. Simultaneously, as the only country in the Central and Eastern Europe, it was ranked among the first six EU countries in terms of total power installed.

The photovoltaic boom in Poland continues

IEO has successfully realised ninth edition of annual report PV Market Report in Poland 2021. Whole report is available in our online shop in English. Check out

The photovoltaic market in Poland is going through a development boom. In the last five years, at the end of 2020, Poland was in the first place in the European Union in terms of the growth rate of photovoltaic power, calculated on the basis of the cumulative annual growth rate - CAGR For Poland, the cumulative (combined) growth rate in 2016-2020 was 114 %, with the EU average of 10.3%. Therefore, in the medium term, we are the European leader in terms of the PV market growth dynamics and in 2020 we approached the world's top 10 countries in terms of power growth (13th place). Successive, better and better international forecasts confirm the strength, potential and growing position of the Polish photovoltaic market.

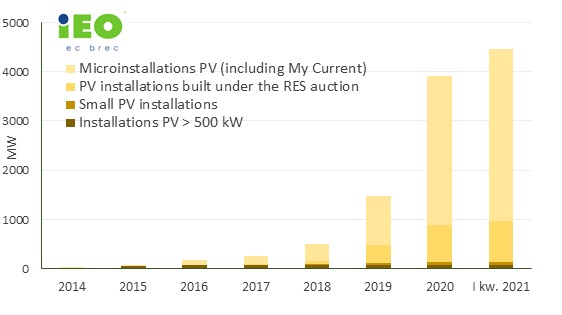

Figure 1 Cumulative installed PV power in Poland, as at the end of Q1 2020, data: ERO, OSD, comp. by IEO.

The installed power is gradually increasing, and the growth rate has been extremely high for two years. 2020 was the best year in the history of photovoltaics development in Poland. The installed power in photovoltaics at the end of 2020 amounted to 3,936 MW, which means an increase by 2,463 MW year on year and translates into a 200% increase year on year. Individual prosumers made the greatest contribution to the increase in new power. Thus, according to Solar Power Europe, in 2020 Poland was in 4th place in terms of increasing the installed PV power in the European Union. Only Germany, the Netherlands and Spain overtook us. According to the forecasts of IEO Poland, in 2021, once again in a row, it will maintain a high rate of power increase and the 4th place in the EU. The IEO estimates that at the end of 2021, the installed PV power in Poland may exceed 6 GW. Forecasts also indicate that the total turnover on the photovoltaic market in 2021 will exceed PLN 9 billion.

The installed power is gradually increasing, and the growth rate has been extremely high for two years. 2020 was the best year in the history of photovoltaics development in Poland. The installed power in photovoltaics at the end of 2020 amounted to 3,936 MW, which means an increase by 2,463 MW year on year and translates into a 200% increase year on year. Individual prosumers made the greatest contribution to the increase in new power. Thus, according to Solar Power Europe, in 2020 Poland was in 4th place in terms of increasing the installed PV power in the European Union. Only Germany, the Netherlands and Spain overtook us. According to the forecasts of IEO Poland, in 2021, once again in a row, it will maintain a high rate of power increase and the 4th place in the EU. The IEO estimates that at the end of 2021, the installed PV power in Poland may exceed 6 GW. Forecasts also indicate that the total turnover on the photovoltaic market in 2021 will exceed PLN 9 billion.

Capacity forecast, leading market segments, growth limits

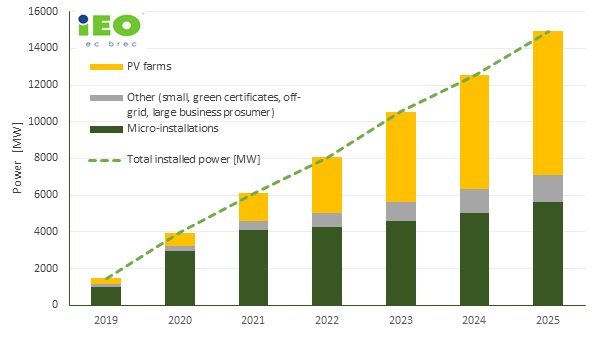

Figure 2 Forecast of the installed power in PV [MW] until 2025, compiled by IEO

According to the IEO forecast, there are no indications for a slowdown in the photovoltaic market in the medium term. PV farm projects prepared for RES auctions, including large-scale ones, will have the main share in the increase in power in the coming years. Even if the pace of development of micro-installations slows down temporarily, the photovoltaics as a whole will not feel this fact in the next few years. It is a flexible, scalable technology, operating in several segments and many market niches. In addition, this year the role of business prosumers will also clearly increase, whose IEO forecasts growth at least 200 MW, and this trend will intensify in the coming years. According to the IEO forecast, the installed power in photovoltaics in 2022 will double its value at the end of 2020 and at the end of 2025 it may reach even 15 GW.

In 2021, photovoltaics may encounter the first regulatory restrictions and related to the limited availability of new projects, both prosumer and farm projects, to the grid infrastructure. Although they do not yet constitute hard barriers limiting further growth, the restriction of access to the Internet may inhibit new investments, even when regulations, the market and the social atmosphere are favourable

RES auctions as the basis for the development of the photovoltaic market

Figure 3 List of auction volumes for wind and photovoltaic projects over the years, compiled by IEO

After 5 years from the announcement of the first auctions, the auction system has become the most important instrument to support the photovoltaic market in Poland. In 2020, the RES auction basket for solar and wind technology with a power of less than 1 MW was once again dominated by solar energy. In 2019, the auction for projects above 1 MW was won by only 3 solar farm projects, but it was a harbinger of increasing competition of photovoltaic technology in this basket. In the renewable energy auction in 2020, photovoltaic installations shared the available volume almost half with wind farms. The distribution of auction prices for the large basket of winning bids shows that large solar and wind projects offered prices at a similar level. This confirms the thesis about the similarity of these markets and the fact that these technologies can already fully compete with each other and one can expect increasing auction volumes for large-scale PV projects.

The market of solar farms up to 1 MW is developing the most dynamically thanks to the auction system. Very strong competition in the "small" auction basket results from the large supply of these projects on the Polish market. According to IEO data, the conditions for connection to the distribution and transmission network are over 5,000. PV projects up to 1 MW with a total connection power of 4.7 GW.

Figure 4 Connection power of projects in individual power ranges, comp. by IEO, based on the database of Photovoltaic Projects in Poland

Currently, in the photovoltaic market, projects of large-scale PV farm (above 1 MW) are already balancing, in terms of connection power, small photovoltaic projects (up to 1 MW). According to IEO database, at the end of March 2021, 610 large solar farm projects with a total power of 5.6 GW had the conditions for connection to the grid. Large PV projects have attracted investors attention for about 3 years. In 2020, 2.8 GW of PV projects obtained the conditions for connection to the grid, and only in the first quarter of 2021 this decision was granted to 1.8 GW of PV projects.

The graph above shows the cumulative power of large-scale PV farm projects in the given power ranges. Among large solar projects, the largest part are projects of large solar power plants - above 50 MW. Most projects in this power area obtained connection conditions in 2020 and in the first quarter of 2021. In 2020, the conditions for connection to the grid were obtained by 10 projects with a total power of 1 GW, while in the first quarter of 2021 the conditions were obtained by 3 projects with a total power of approximately 615 MW.

PV industry and technology supply chain to the market

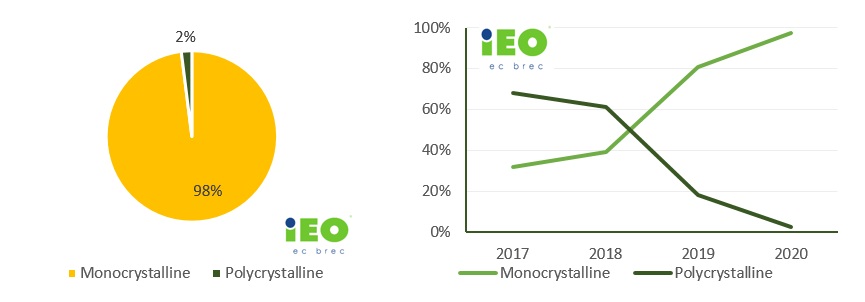

Figure 5 Structure of sales of modules on the domestic market in recent years, compiled by IEO, based on the PV market research conducted by IEO in 2018-2021.

This year's market research showed that monocrystalline modules absolutely dominated the market. It turns out that polycrystalline modules constitute only 2% of the modules introduced to the market by the surveyed sellers. The high share of monocrystalline modules in the market is in line with the trend that was observed in last year's study, when the share of monocrystalline was 80%. However, the almost 100% domination of this type of modules is a surprise. This is due to the fact that in 2017 and 2018 the situation was completely different and it was polycrystalline modules that covered most of the market. The change in the structure of the domestic market of sold modules took place in just 3 years

The PV market is not only the sale of installations to end users, but the entire supply chain generating added value for the economy. According to IEO analyses in photovoltaics, in 2020 the number of full-time employees in the industry could reach even 14.5 thousand while the number of people temporarily working in other forms of employment in photovoltaics may reach 21,000. It is a total of 35.5 thousand jobs in the domestic photovoltaic sector. Employees from the photovoltaic industry constitute a significant group of stakeholders who care about the development of the sector. This opens opportunities for the government and/or the regulator to dialogue with the industry and reach an agreement on the development of directions and support for the development of the entire photovoltaic sector in Poland.

Click on image to look into PV Market Report in Poland 2021